The Bigger TAM Is In Established Markets

Growing up, I was promised flying cars, but all I got for Hanukkah was an iPhone. Today’s generation is being sold the promise that the singularity is around the corner. But most Americans download and email PDF versions of their paystubs to their bankers. Over and over again, shiny objects like AI or Blockchain live rent-free in our board rooms but are disconnected from real-world results.

End markets for income data follow a similar path, with most consumer-facing businesses finding a cool way to use payroll data. At Argyle, we have talked to LinkedIn, Indeed, and Tinder about using income data to auto-populate profiles. Where has Argyle found its stride? In established markets with non-ventured-backed companies. I’ve been to the NewRez office in Fort Washington, Pennsylvania, and the SafeRent office in Irving, Texas. These are dominant & profitable operators in their respective markets that don’t have robots roaming the hallway. Instead, these established firms run scaled operations the good old way – with emails, PDFs, phones, and faxes.

And now, we find ourselves at the heart of the matter. Far too many businesses today are being sold the flying cars of our time: that some AI chatbot is going to revolutionize their businesses. But all they want for Hanukkah is a more efficient way to get a consumer’s income data for underwriting. Lenders, tenant screeners, mortgage originators, and background check providers are looking to solve a practical problem: getting income data more reliably than forwarding an email with attachments.

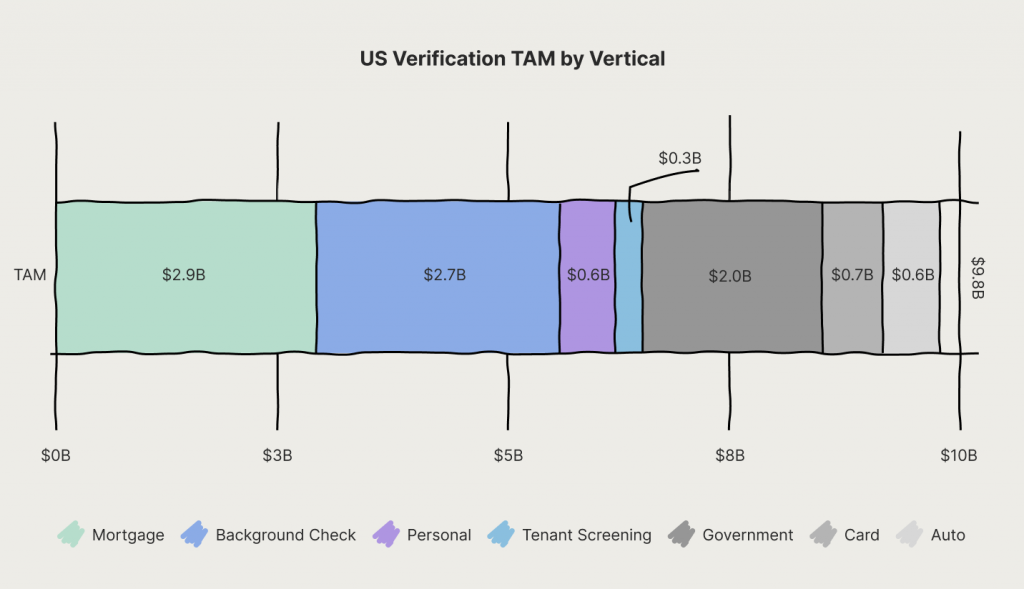

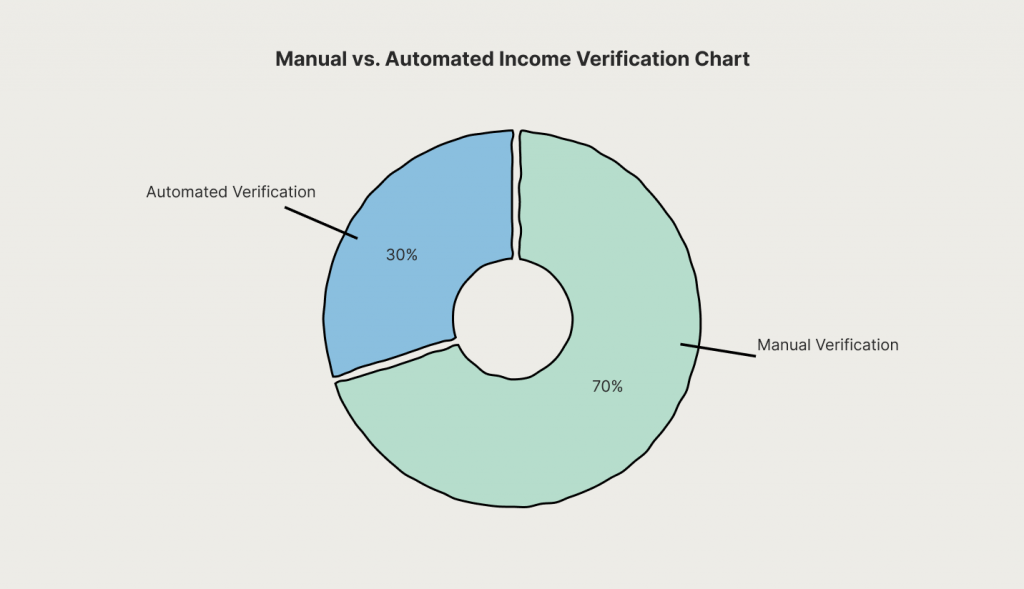

$10B. That’s how much Morgan Stanley says is spent verifying consumer income each year. And that part that is really going to cook your noodles is that 70% of this spend is on manual methods (emails, PDFs, phones, and fax). What is Argyle? A more efficient way to get consumer income data. Not with some pie-in-the-sky concept, but with a practical approach.

Practical solutions don’t need to create new markets or dramatically expand TAM. The TAM is already there. And while it would be fun to talk your ear off about all the novel technologies we have built to connect and process payroll data in real-time from hundreds of data sources, none of our clients need that sci-fi. Instead, a lender looking to switch to automated verifications needs an income verification report, normally in a human-readable PDF format. So, we suppressed our API from most of our clients as well.

This year, for Hanukkah, the income verification market gets an iPhone. Not a flying car.