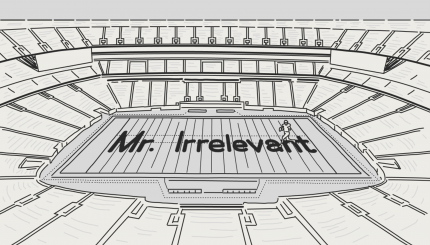

Mr. Irrelevant

In 2022, the 49ers selected Brock Purdy as the 262nd pick in the NFL draft as their third-string quarterback. For the uninitiated, that’s dead last. Mr. Purdy will earn $870,000 for the 2023 season, making him the lowest-paid quarterback in the NFL. Compare that with household names like Joe Burrow ($55M), Patrick Mahomes ($53M), and […]